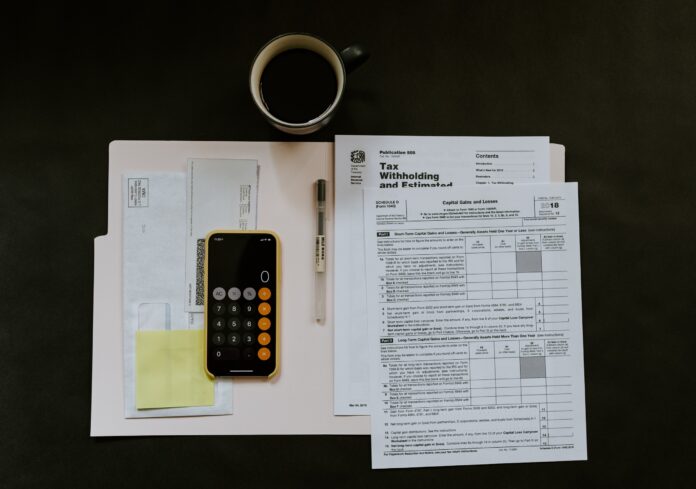

Who Are Tax Consultants?

Tax consultants, also known as tax advisors, are tax specialists who are experts in handling matters of tax and tax laws. They work for the compliance of legislation relevant to tax and guide professionals on tax-paying liabilities.

They work for organizations as well as individuals and keep them updated with any modifications made in tax norms and help filing tax returns along with minimizing liabilities.

What Are The Roles And Responsibilities of a Tax Consultant?

A tax consultant is expected to perform the following duties

- Sorting out tax forms

- Helping in filing a tax return

- Updating the clients about tax law amendments

- Advising on legal issues and formalities

- Instigating communication between client and legal authority

- Ensuring that the clients make the best business decisions with regard to monetary matters

- Promoting tax-efficient employee benefits

- Calculating the tax liability and ensuring compliance

- Maintaining tax records and receipts

What Are The Skills Required For Being a Tax Consultant?

A tax consultant must be well equipped with both – hard and soft skills. The hard skills of tax consultants include quantitative and legal aptitude i.e., mathematics, accounting and law. The soft skills that this role asks for are comprehensiveness, sense of responsibility, right communication of complex facts, ability to give advice and reliability.

A tax consultant must be adept with written and verbal communication skills and must possess the capability of proper transferring statistical and strategical tax information. They have to be a good researcher and analysers as one has to stay updated with the contemporary modifications in law or fiscal policy.

Often tax advisors have to meet up with senior clients so maturity and confidence are advisable to them.

What is The Salary Scope of a Tax Consultant?

The perks and benefits of being a tax consultant/advisor are many. It often comes with the experience and expertise of the individual in the field.

Normally, in India, the average salary of a tax consultant is Rupees 6 lakhs per annum which can go as high as 8 lakhs per annum. The lowest salary in India is Rupees 4 lakh per annum.

The salary defers according to the positions of the person- an average senior tax consultant can fetch 50k per month while a tax associate can fetch 25k per month.

How Can You Become a Tax Consultant?

There is a beaming question after all the perks whether I can become a tax consultant? Surely you can! Provided you have a bachelor’s degree either in economics, finance or law.

Along with that, you will be needing training as a tax clerk or a study course in selected programs. These courses could be named Tax theory or business studies with the impetus given to subjects like taxes, finance, accounting or taxation.

Different industries demand specialized roles, so you need to be adept to be able to adapt yourself to the requirement!

If you are pursuing it through chartered accountancy then you will have to clear entrance exams for the same.

With a relevant degree, qualifications, certificates and required skill set you are all set to pursue the profession of a tax consultant.

Why Do We Need a Tax Consultant?

Reasons to have a tax consultant are numerous, a few of them are mentioned below:

- Saves time.

Having a tax consultant saves your time from the hustle and bustle of tax formalities. You can just concentrate on your mainstream work and put the burden of taxes on a professional who is made to handle them with ease. If you are looking for tax consultant near me then Qwirk is the best platform.

- Get to know your deductions.

Via a tax consultant, you will be able to identify the deductions that were hidden because of a lack of knowledge. It will help you save a lot in return for a small fee.

- Safe and Legal

Hiring a tax consultant who is verified is safe and under the boundaries of legalities.

- A full-time advisor.

A tax consultant, apart from being a tax advisor, can also help you with other significant fiscal policies. It leads to a better grip on financial matters.

In a Nutshell

As mentioned above a tax consultant is a virtuoso in tax matters and can ease all the financial heft off your shoulders. They help you reach absolute decisions and aid you with running the business-backed with sound fiscal compliance.

Read Also: lausd email: Best way to get access in 2022